People are increasingly concerned about climate change and have had personal experiences of its effects — 93 percent say they believe climate change poses a serious and imminent effect to the planet, according to the recently released 2023 Edelman Trust Barometer Special Report: Trust and Climate Change. The study also found that 67 percent of respondents say there is a meaningful gap between how climate-friendly their lifestyle is and how climate-friendly they would like it to be. These findings, along with recent data out of the NYU Stern Center for Sustainable Business (CSB), indicate that brands must help consumers reach their goal of living a more sustainable lifestyle while continuing to provide excellent, useful products.

CSB has tracked consumer behavior in the U.S. for a decade, looking at actual purchasing of sustainability marketed products, using Circana data (tracks bar code data for all consumer packaged goods sold in the U.S.). We have found that sustainability-marketed products are growing twice as fast as conventional, and on average are priced at a 28 percent premium. We have also found that purchasing of products with carbon-specific claims has accelerated, growing from close to zero in 2019 to $1.9B in 2020 to $3.4B In 2021. We see environmentally friendly alternatives in most categories begin to shift demand to the point where categories such as dairy have approximately 60 percent of the products marketed as sustainable. Brands are recognizing this shift: In 2021, one of every two newly introduced CPG products sold had sustainability attributes. And we see that when legacy leaders incorporate sustainability into their supply chains and communicate those benefits to consumers, it becomes “table stakes” to compete (as we have seen with leaders such as Dove in skincare).

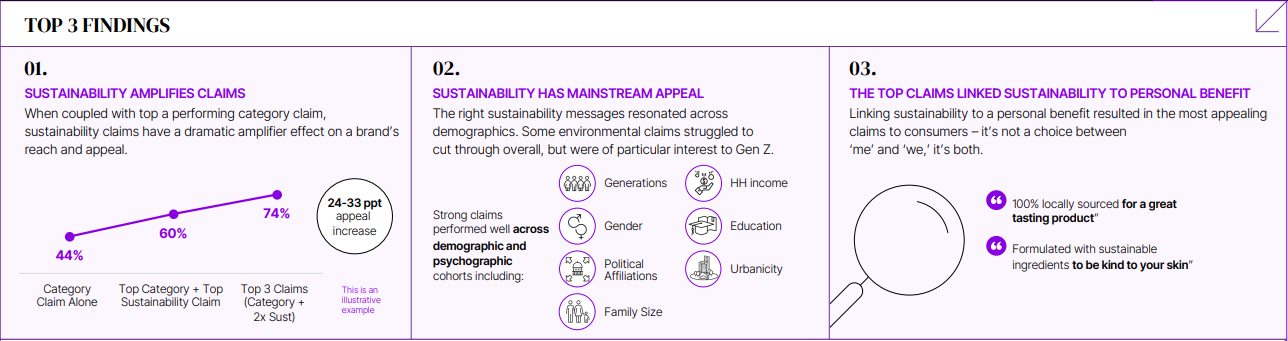

Despite this evidence, brands tend to be risk-averse and worried about turning off customers with sustainability messaging or developing ineffective messaging. NYU Stern CSB and Edelman partnered on a novel research project with nine iconic brands to understand which environmental sustainability messages (if any) work best with consumers. We were delighted to find that the right sustainability messages operated as an amplifier, significantly strengthening a brands’ positioning and attracting new audiences, versus a core category claim alone. As you might expect, communicating about the core attribute of the product is the first and generally most important message. Nobody wants to buy sustainable chocolate that does not taste delicious. But laddering up to two sustainability messages onto the core attribute message drives far greater appeal, from 44 to 74 percent (see figure below), across political party, age, education level, and income.

The messages that work best relate to the consumer and her/his world (see figure below). Messages related to how the product could help their health (made without ingredients harmful to human health), their pocketbook (uses less energy to save you money), their children (made to ensure food supply is available for future generations) their animals (not tested on animals) and their local farmers (working with local farmers to…) were extremely effective. Local and 100 percent sustainable sourcing claims also drove significant purchase intent.

Claims that did not work well included scientific claims (e.g. biodegradable, climate neutral), traceability claims, packaging claims (except made with 100% recycled material) and certifications (though credible certifications provide proof points and help to guard against greenwashing). In one interesting departure, Gen Z tended to respond better to scientific claims related to climate, perhaps because that is their personal world for them.

The takeaways from these three studies demonstrate:

- People are willing to buy sustainable products, even at a premium, and are continuing to ramp up those purchases.

- Sustainability messages that build on core attributes and show what is in it for the consumer work very well across all cohorts.

- When market leaders change, adopt, and communicate sustainable messages, then the category changes because it is table stakes to compete.

- Climate optimism leads to action and brands can build on a belief in opportunity through genuine sustainability action carefully and authentically expressed.

Many brands believe it is better to be cautious and pursue a business-as-usual approach. The problem with that is that it is likely that other offerings and brands will pass you by. When we first looked at dairy purchases in 2019, we saw that conventional dairy demand was in a slump, while demand for sustainable versions was large and growing (and continues to grow). That same year, the two biggest dairy producers in the U.S. declared bankruptcy. To be successful, brands need to support consumers in their goal to enjoy a fun and meaningful lifestyle that affords them the quality and convenience they demand in a sustainable way.

Tensie Whelan is a Director at NYU Stern Center for Sustainable Business and Randi Kronthal-Sacco is a Senior Scholar at NYU Stern Center for Sustainable Business.

© Philip — stock.adobe.com