The 2019 Edelman Trust Barometer: Food and Beverage report brings to light a sector experiencing a slight recovery in trust after a four-point drop in 2018 yet it is not keeping pace with recovery and growth in trust in business overall. When evaluating results across the 26 markets, most of them are not back to their 2017 trust levels and the food and beverage sector garners higher levels of trust than business in general. However, over eight years, food and beverage trust levels moved from 64 to 68 percent, while trust in business increased from 47 to 56 percent. When we look at food and beverage sub-sectors, we also see a slight recovery in all of them, with the exception of additives which was just added in 2019.

These findings confirm that while trust in the sector experience a slight recovery, trust is not necessarily stable, but rather fragile.

DOWNLOAD THE GLOBAL RESULTS

Hungry for more

When analyzing the behaviors that build trust, we found out that the sector is behind in operating with transparency and authenticity and has shown almost no recovery in developing innovations that have a positive impact in people's lives. Despite having a better performance in ensuring quality control, given the nature of the sector, a good score at this behavior is essential to drive trust thus confirming that the sector is not keeping up with expectations.

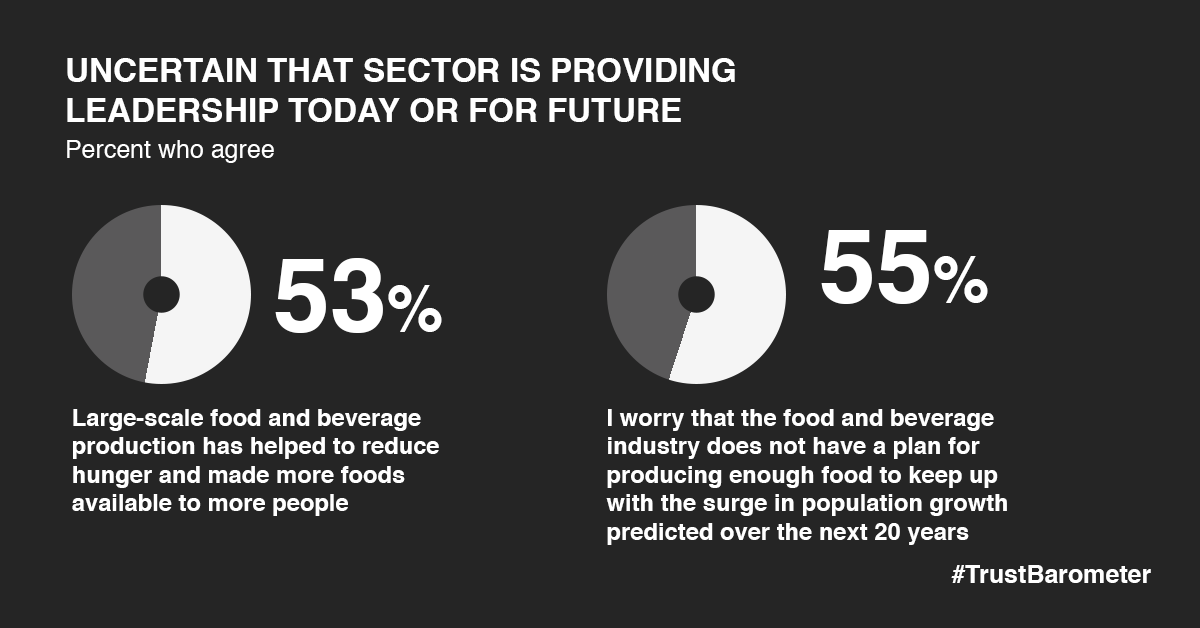

We also identified that while a slight majority believe that large scale production has helped reduce hunger, there is a strong belief that there is not a plan to produce enough food for the future population; and there is even less doubt that the sector has harmed the environment and lowered nutrition standards.

It is not just the general population who is concerned and expecting the sector to do more; these skeptical sentiments are held by people in the industry as well.

We also looked at food and beverage employees’ perception of the sector. As witnesses of the efforts to improve innovation, nutrition and environmental practices, we would expect them to have a more positive view, but overall employees share the same concerns about the future, their overall health and the environment.

Building trust from the inside out

Food and beverage employees also look to their employer to lead the change (73 percent versus 71 percent of the General Population); and to be a trustworthy source of information about contentious societal issues (53 percent versus 58 percent for the General Population).

We identified the expectation compared to their levels of trust as an opportunity to build trust. When employees trust their employers, the dividends are significant. In fact, food and beverage employees who trust their employer are far more likely to engage in beneficial actions on their behalf—they will advocate for the organization (a 34-point trust advantage), are more engaged (31 points), and remain more loyal (33 points) and committed (32 points) than their more skeptical counterparts.

Like employers in general, food and beverage companies have an opportunity to engage more directly and regularly with their employees and also to activate their voices in building trust outside the company and with all stakeholders.

Building trust with all stakeholders

- Underscore your contribution to the greater good. It is imperative that you lead on change: Having a purpose, and sharing it, are crucial ingredients for building trust while making a positive impact on society.

- Be transparent and authentic. Make sure you are leading on relevant issues and that you are bringing your stakeholders with you on that journey. Be transparent and authentic about everything with everyone.

- Engage the CEO in leading with purpose. CEOs are expected to lead change, engage directly, be visible and show a personal commitment, both inside and outside the organization.

- Engage your employees and activate their voices. Include your employees, give them a voice, create opportunities for shared action and empower them with information. When employees feel empowered, they become your source for building trust outside the organization.

With bold action and a new employer-employee contract, the potential for building trust capital has never been greater.